Learn what it method for assume a mortgage loan and exactly how a presumption could be able let your prevent a foreclosure.

Whenever you are at the rear of on your mortgage payments and want to signal along the deed to your residence to some other holder, that you’ll be able to solution to prevent foreclosures is an expectation. In the event that the fresh new manager takes on the mortgage, that individual becomes truly responsible for the loan financial obligation.

Otherwise, for individuals who inherit a good mortgaged assets, or score possession courtesy a divorce case or any other intra-members of the family transfer, but can not afford the repayments, of course, if the loan as an element of that loan amendment you’ll make it that contain the property.

Skills Promissory Notes and Mortgage loans

Before you completely understand just what it method for suppose an excellent financing, you must comprehend the difference between a promissory notice and you will home loan otherwise action regarding faith. (For the purpose of this post, the latest terminology “mortgage” and you may “deed away from faith” are used interchangeably.)

Somebody commonly use the term “mortgage” to mention so you’re able to both the promissory mention and you will home loan. But the notice is the document that create the responsibility so you can pay the mortgage. The mortgage, while doing so, provides the lender an effective way to impose who promise-that’s, the lender may foreclose and employ the fresh new arises from this new property foreclosure revenue to settle the mortgage.

Following a property foreclosure, during the most claims, the lending company can go pursuing the borrower with the deficit between the fresh foreclosures sale price in addition to borrower’s total obligations. The fresh new promissory notice sets a great borrower’s liability towards the deficiency.

So what does It Imply to visualize that loan?

A presumption is actually a deal in which a unique person gets control monetary liability to the financing-often having or versus a discharge of the first borrower’s accountability.

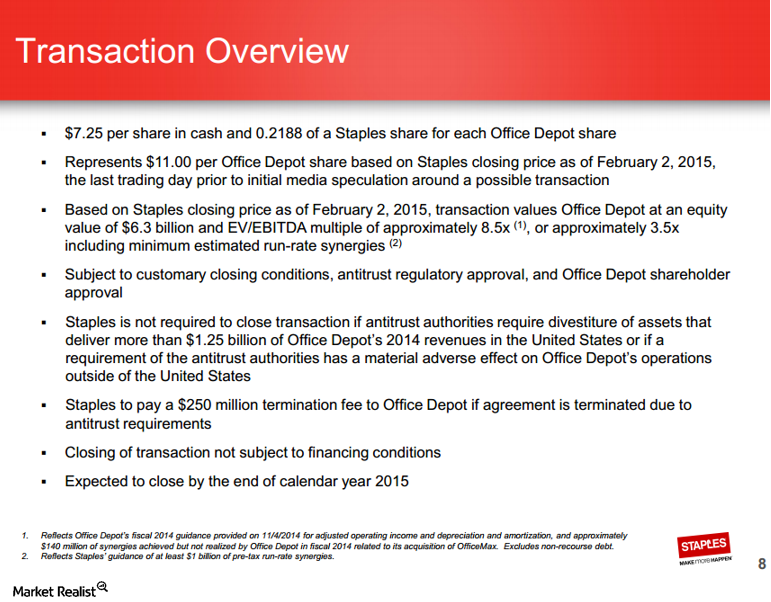

Here’s how an expectation generally functions: Say, you want to promote your house and you may deed they to a different group, with that the latest manager overtaking obligations having paying the borrowed funds you got out. If the a presumption are acceptance, the lender will usually require the the latest owner so you’re able to meet the requirements and proceed through an affirmation process to suppose the loan. The lender will probably manage a credit check towards visitors, including be sure the new consumer’s a career and you may money. As presumption is approved plus the expected files are signed, the consumer steps into your (the original borrower’s) shoes and you can begins putting some monthly installments and you will conforming along with other regards to the existing financing. The borrowed funds words, interest rate, dominating balance, and monthly payments remain the same. Your (the seller or transferor) will continue to be responsible for your debt except if the financial institution launches you from this obligation. The homeowner in addition to takes on personal responsibility to the financial obligation.

Debtor Accountability Following the an assumption

In a number of presumptions, the lender commonly launch the first borrower on the duty composed because of the promissory mention. However in other times, the initial debtor stays responsible towards mention. So, dependent on condition law therefore the affairs, in case your the brand new owner stops and come up with mortgage payments and you can loses the fresh new the place to find property foreclosure, the lender you are going to come adopting the new borrower, along with the person who believed responsibility, to possess an insufficiency view to gather your debt.

Due-On-Income Term: How do i Know if My personal Mortgage is Assumable or not?

Whether your documentation says your mortgage try assumable, you might import the house or property and you can loan to some other holder. In the event your financing deal try hushed with this amount, even though, in most states, the borrowed funds is recognized as assumable.

However, many, otherwise extremely, home loan contracts consist of what’s titled a “due-on-sale” supply. This condition states whenever the property was moved to a the latest proprietor, then your full loan equilibrium can be expidited, and thus the entire harmony https://availableloan.net/loans/wedding-loans/ of loan must be paid. Essentially, whenever home financing provides a because of-on-income clause, the loan cannot be believed.