You could potentially unlock that within almost one financial or borrowing from the bank commitment, often entirely online and in just a little otherwise zero initially put. Such membership dependably spend the money for said interest rate and most has smaller charge however some costs no costs. But not, the attention obtained toward savings accounts is too reasonable to save with rising cost of living, increasing the case of if or not discounts accounts are worth that have in the all the. Despite this, most People in america do use deals accounts in addition they bring extremely important professionals.

Checking account Maxims

A family savings is a type of account supplied by an effective financial or credit relationship one will pay you attract replace into utilization of the money your deposit. Such loan providers use the cash in savings membership and come up with funds to people and you can companies.

Lots of banking institutions and you can credit unions, in addition to on line banking companies, promote discounts accounts. You might open a savings account because of the completing an application and you can and come up with in initial deposit. Tend to, this can be done completely on the internet and sometimes instead placing people money to start.

Coupons account costs lower solution costs, normally not absolutely all dollars a month. Some discounts account costs no monthly charges at all. Coupons profile https://paydayloanalabama.com/panola/ essentially succeed distributions from the online import, the means to access an atm cards otherwise by visiting the bank, However, he is not the same as checking profile, that are as well as offered by financial institutions and you can borrowing from the bank unions.

Examining membership, some of which shell out attention as well, are created to be employed to pay bills and also make regular distributions. Deals accounts, likewise, often restriction how frequently you can withdraw currency for some moments four weeks otherwise less.

Savings account interest rates are usually lower as compared to productivity people can get for the stocks and you may similar assets. Currently, of several major banking institutions promote yearly fee efficiency from only 0.01% with the coupons profile. High-give discounts membership supplied by some less and online finance companies can get shell out 2.0% % or higher.

Money placed inside deals profile is considered positively safe from loss. This is because offers dumps is actually covered by the Government Put Insurance Business. No-one have previously forgotten money from an FDIC-insured account. It defense arrives at a price, although not. That’s because the lower interest rates reduced toward deals dont ensure it is savers to keep track rising prices. Currency put in a savings account will always cure purchasing fuel through the years.

Of numerous savers fool around with offers is the reason emergency discounts and also to gather fund to possess short-label requires or even to make major orders, such a down-payment into the property. Given that coupons levels is actually independent in the examining levels always pay the bills, of many savers view it more straightforward to stop spending the bucks into the an impulse.

Savings Profile Positives and negatives

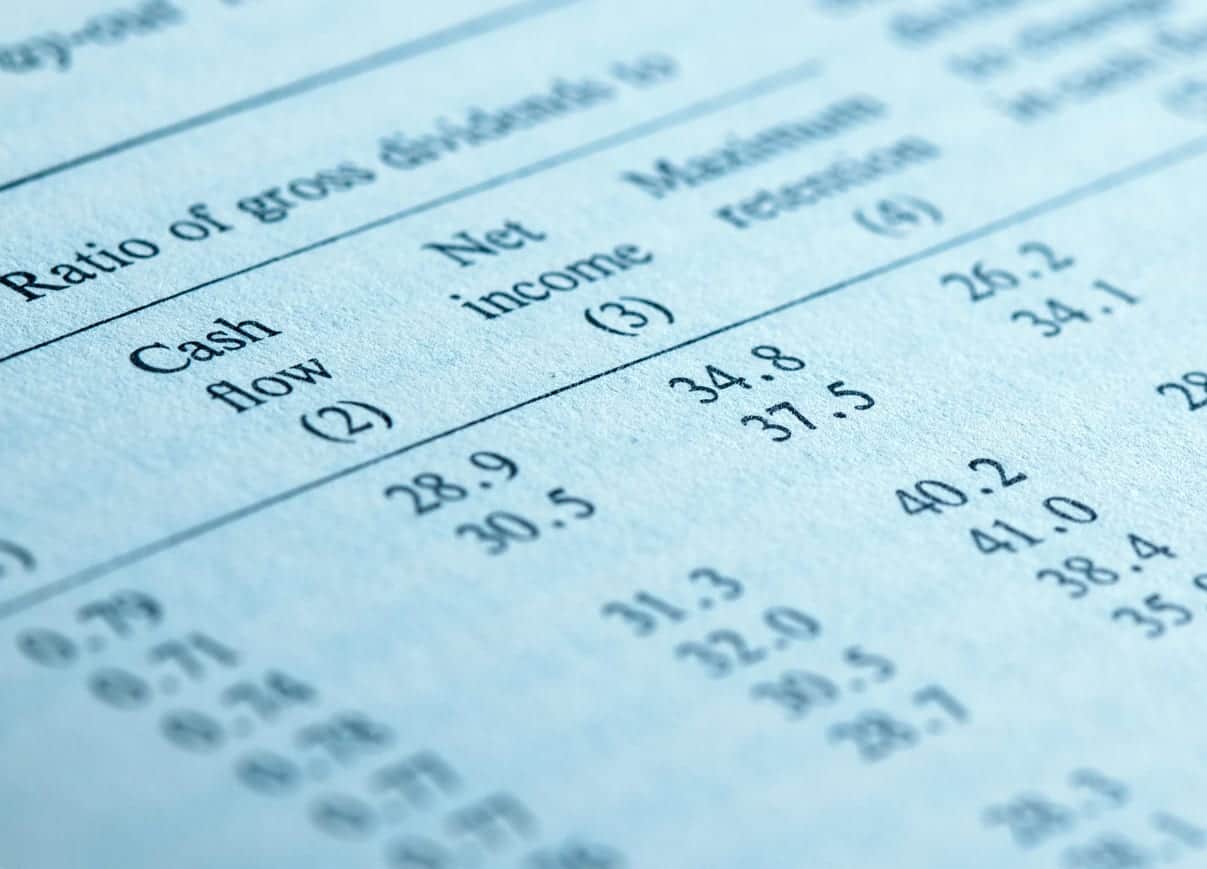

So you’re able to gauge the benefits and benefits associated with coupons account, here is a dining table to your trick enjoys defined:

Keep in mind that not totally all savings accounts are designed equally, and every ones could possibly get implement differently to different profile.

Greatest Uses for a savings account

A discount accounts is among the best place to keep disaster coupons. Talking about savings, preferably amounting to 1 to 3 days regarding very first expenditures, that will be kept in matter-of any emergency such good pricey fix statement. The fresh breakup and you can large liquidity given by coupons levels make sure they are ideal for which goal.

Deals profile are effective ways to gather loans getting quick-identity savings wants that can already been due within three-years otherwise very. A property advance payment, yet another vehicle, a married relationship otherwise a holiday all are short-identity coupons goals employing discounts accounts. Discounts membership are more effective to own racking up financing having quick-label needs than many other financial investments, eg carries, since there is zero risk of the value of the latest account declining simply whenever loans are needed.

Those with an extremely reasonable tolerance to own exposure also are a great people to have coupons accounts. Highly losings-averse traders get remain more cash inside the coupons membership than many other people, restricted to comfort. not, also coupons membership are not completely risk-free, because of the likelihood one loans manages to lose coming to get power because of inflation.

The bottom line

Savings membership are smoother, secure, low-rates metropolitan areas to develop discounts to have problems otherwise biggest requests. Yet not, the reduced rates it spend imply rising prices commonly consume towards the new to get fuel of cash kept in them. Controlling this type of advantages and disadvantages signifies that keeping some although not all money in a family savings is reasonable for pretty much everyone.