If so, with these pros and cons list, we are able to help you make the best decision. Getaways rotate around self-confident opportunity therefore let’s begin with the advantages.

He or she is a form of a personal bank loan useful for travel costs. You will get her or him courtesy extremely lenders having a standard individual loan application process.

This action normally requires that your give personal information having a beneficial smooth inquiry. Travelling finance basically have small amounts having partners limitations so lenders are happy to take on this type of loan agreements.

Individuals with a good credit score score get discover most readily useful cost. Thus their monthly payments are a lot more in balance than the individuals for a loan having a high rate of interest.

This will enables you to make loans Norwood CO use of your loan payments in the funds and be at ease with paying back the borrowed funds count.

That’s better, unsecured loans or a credit card financing?

Individual traveling finance known as travel financing are located in fixed wide variety as they are paid having a foreseeable month to month costs.

As your equilibrium develops on your bank card therefore is also their costs. That have a vacation loan, your repayments and you may interest are always stay a comparable.

Is actually Eden Really worth Financing?

Great question, that is personal and you will dependent on a situation the view can differ. Although not, does all of our best to leave you conscious of several things just be aware of.

Vacations shall be high, and you can a significantly-needed stress reliever. Whilst you will want to keep in mind that when you pull out a vacation financing that loan bank will anticipate you to pay it straight back.

With a simple monthly percentage package repaying, the mortgage shouldn’t be too much of a challenge. If you were accepted just be in a position to be able to pay-off the mortgage. not have a plan to pay what you’re browsing are obligated to pay, and if you are planning to have trouble definitely communicate with your own lender.

It certainly is best to pay money for consumables, such as for example a holiday, ahead that have currency you have conserved on your own.

Even though if you’re wanting a vacation, vacation or personal travel, and you are comfortable with tomorrow month to month costs an excellent trips loan is a good idea for you.

All in all, whether or not an utopia is worth investment tends to be something that you have to select the however with this list at the least you understand two things you should consider first.

We truly need one getting at ease with your commission alternatives thus you might really relax and you may sink towards travel function.

Latest Listings

- The fresh new Mariner Loans internet feel not far off!

- As to the reasons Favor an area Financial?

- Going for a home loan company: Certain Concerns to inquire about

- Do you Score that loan to have a married relationship?

- 3 ways to settle Your car or truck Mortgage Early

- Car Info

- Profession Recommendations

- Economic Tips and advice

- Getaways / Seasons

We provide signature loans of $1,100000 to help you $twenty five,100000, with funds conditions away from 12 in order to sixty weeks. Minimal and restriction quantity determined by an enthusiastic applicant’s county regarding house additionally the underwriting of your mortgage. Loans anywhere between $1,500 and you will $fifteen,000 is generally funded online. Financing greater than $fifteen,100000 otherwise lower than $step 1,five hundred is financed using our branch community. Particular interest levels and you will fees have decided given that let less than relevant county laws and you may rely upon amount borrowed, name, while the applicant’s capability to meet our borrowing standards, in addition to, although not simply for, credit score, earnings, financial obligation payment financial obligation, and other circumstances such as for example method of getting collateral. Not absolutely all pricing and you will mortgage quantity appear in the says. Even more fees may apply to certain loan offers; specific state necessary and/otherwise allowed fees could be addressed while the prepaid service fund charge. Such charges is as well as the amount borrowed requested and/or accepted and can be totally shared to your candidate for the his/her financing agreement. Only a few people will be eligible for a minimal pricing or big financing amounts, that may need a primary lien on a motor vehicle maybe not over 10 years old called regarding the applicant’s term that have appropriate insurance. Our very own financing by the phone an internet-based closure techniques needs a suitable mobile or computer system product on which you can access the current email address and you can electronic files. Not all the financing models are eligible to own mortgage by cell phone or on line financing closing.

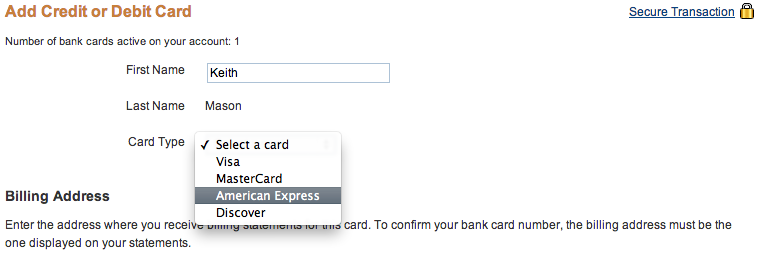

To aid the federal government battle brand new financial support of terrorism and money laundering products, Federal laws needs most of the financial institutions to get, ensure, and listing recommendations that refers to differing people whom reveals an account. This is why, significantly less than our customer identification system, we should instead require your label, physical address, emailing address, day regarding delivery, or other pointers that will enable us to pick you. We could possibly along with ask observe their license and other determining files.

For your mentioned annual percentage rate (APR), brand new Apr means the expense of borrowing while the an annual speed and also be calculated reliant an applicant’s credit at the lifetime of software, at the mercy of condition rules limits. A variety of APR’s is applicable, at the mercy of state legislation restrictions and you can private underwriting. Never assume all candidates will qualify for a lower rates. APR’s are usually large into the money perhaps not secured by a motor vehicle, therefore the low cost typically apply at one particular creditworthy individuals. Most of the terms and conditions off a loan bring, like the Apr, could be unveiled when you look at the app processes. For instance, that have a price financed from $5, the fresh new debtor gets $5, from the an apr regarding % and an interest rate off % which has a money charges off $3,. Lower than these terminology, this new debtor would make forty-eight monthly obligations out of $, to have all in all, repayments off $8,. The quantity funded is almost certainly not the web continues paid down if the fees besides desire are part of the loan.

*The method uses a beneficial soft borrowing inquiry to decide if or not that loan give exists, which doesn’t effect your credit score. For folks who continue the application techniques online and undertake an effective loan provide, or is described a department and continue the job around, we will remove your credit report and you may credit rating once again having fun with an effective hard borrowing from the bank inquiry. Which hard credit query could possibly get feeling your credit rating.